WHEN IT COMES TO YOUR FINANCES,

YOU WANT PEACE OF MIND

Here’s How I Work

My clients rely on me for objective advice and planning that goes beyond the numbers. Family harmony, business succession, estate equalization, and privacy are all considerations that are carefully discussed and planned around.

As an independent advisor, I have access to the marketplace for the best solutions that are tailored to your unique planning needs. I am competitive, creative, and have accomplished plans that:

- Allow you to plan your finances to build and protect your wealth

- Let you be in control of your financial destiny – we provide the comfort and

confidence of knowing where you’re at and how to get to the next level - Help you achieve the best balance of lifestyle today with security for tomorrow,

and certainty for the next generations

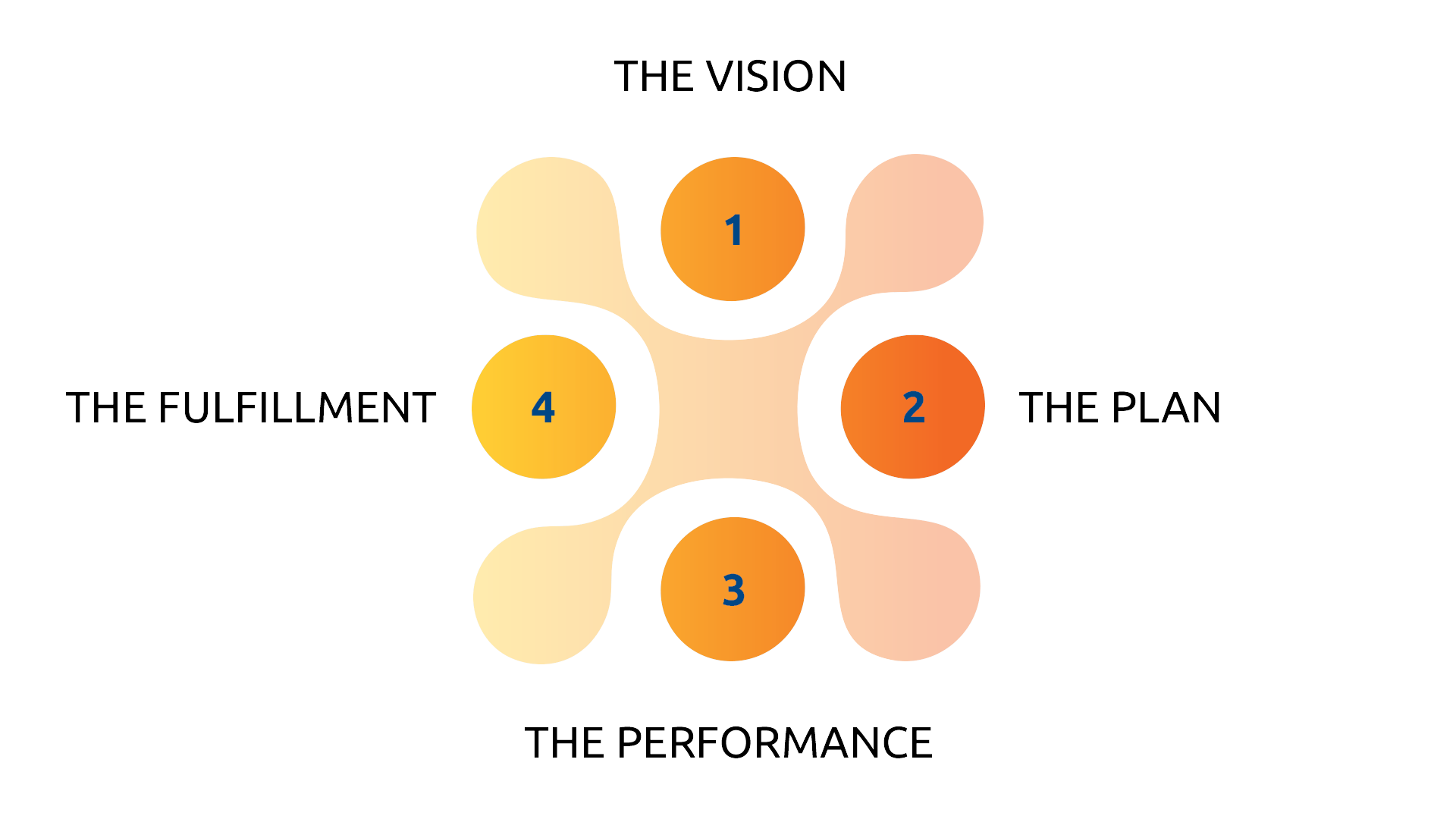

A FINANCIAL PLANNING PROCESS

The Meaningful Life

1. The Vision

What would you like to see happen? If all things aligned where would you be, what might that look like? A vision for your future brings focus and clarity to the ‘ends’ of your accomplishments. It answers where all the ‘means’ are taking you.

2. The Plan

This defines the goals and the timelines that have come out of your vision process. This gives us rails to run on and is the blueprint we come back to in order to measure progress and results. This plan ensures you are creating the margin you’d like to see with your schedule, emotions, risk tolerance, and finances.

3. The Performance

This is a balance between what we have both agreed to work on and commit to. This is what we discuss in the ongoing meetings to see ‘what’ if anything has changed. How is the growth, the deposits, the marketplace, the income, the portfolio, the timeline all working towards the Plan?

4. The Fulfilment

Once we reach your cottage, income, debt-free, lifestyle, inheritance, charitable goal – what else would you like to plan for? This is where we rinse and repeat. The Meaningful Life Planning Process is a proven and repeatable tool that is used to create more meaning and fulfillment in your world.

THE COMPREHENSIVE PLANNING PROCESS

Made Simple for Solutions

WHAT DO YOU HAVE IN PLACE FOR YOUR LEGACY?

Here’s My Expertise

CORPORATE & PERSONAL INVESTMENTS

- On-Going Portfolio Management

- Portfolio Construction

- Monitoring & Implementation

- Understanding Risk Tolerance

- Progress Updates

- Determining Rates of Return

RISK MANAGEMENT

- Risk Blindspots

- Loss of Income Due to Illness

- Coordinating Insurance Planning

- Selection for Long-Term Care Options

- Reducing Personal or Business Risks

- Providing for Surviving Spouse and Family

LEGACY & ESTATE PLANNING

- Maximize Estate Value

- Minimize Taxes

- Inheritance Planning

- Family Planning

- Maximize Wealth Transfers to Beneficiaries

- Coordinated Estate Planning with Other Advisors

QUALITY FINANCIAL PLANNING

- Retirement Planning

- Cash-Flow Planning

- Lifestyle Planning

- Plan Overview Strategies

- Progress Update Process

Tax Planning

- Tax Change Updates

- Tax Efficient Portfolios

- Tax Efficiency Planning

- Coordinated Tax Planning with Other Advisors